Public sector day of action on strikes yesterday.

Health workers expect the Con-Dem coalition governments health changes to increase inequalities and reduce the standard of service.

NHS workers will see any pay rises capped at 1% for two years.

There is an alternative: The case against cuts in public spending – PCS

…

Tax justice

Addressing the ‘tax gap’ is a vital part of tackling the deficit. Figures produced for PCS by the Tax Justice Network show that £25 billion is lost annually in tax avoidance and a further £70 billion in tax evasion by large companies and wealthy individuals.

An additional £26 billion is going uncollected. Therefore PCS estimates the total annual tax gap at over £120 billion (more than three-quarters of the annual deficit!). It is not just PCS calculating this; leaked Treasury documents in 2006 estimated the tax gap at between £97 and £150 billion.

If we compare the PCS estimate of the tax gap with the DWP estimate of benefit fraud, we can see that benefit fraud is less than 1% of the total lost in the tax gap (see diagram opposite).

Employing more staff at HM Revenue & Customs would enable more tax to be collected, more investigations to take place and evasion reduced. Compliance officers in HMRC bring in over £658,000 in revenue per employee.

If the modest Robin Hood tax – a 0.05% tax on global financial transactions – was applied to UK financial institutions it would raise an estimated £20-30bn per year. This alone would reduce the annual deficit by between 12.5% and 20%.

Closing the tax gap, as part of overall economic strategy, would negate the need for devastating cuts – before even considering tax rises.

Our personal tax system is currently highly regressive. The poorest fifth of the population pay 39.9% of their income in tax, while the wealthiest fifth pays only 35.1%. We need tax justice in personal taxation – which would mean higher income tax rates for the richest and cutting regressive taxes like VAT and council tax.

Cut the real waste

While it is not necessary to cut a penny in public expenditure due to the ‘deficit crisis’, there are of course areas of public spending which could be redirected to meet social needs.

In the civil and public services, we know there are massive areas of waste – like the £1.8 billion the government spent on private sector consultants last year. The government could get better advice and ideas by engaging with its own staff and their trade unions.

There is also the waste of the government having 230 separate pay bargaining units, when we could have just one national pay bargaining structure.

There are also two other large areas where government costs could be cut.

Trident

The current Trident system costs the UK around £1.5 billion every year.

A private paper prepared for Nick Clegg (in 2009, when in opposition) estimated the total costs of Trident renewal amounting to between £94.7bn and £104.2bn over the lifetime of the system, estimated at 30 years. This equates to £3.3bn per year.

At the time Nick Clegg (now Deputy Prime Minister) said: “Given that we need to ask ourselves big questions about what our priorities are, we have arrived at the view that a like-forlike Trident replacement is not the right thing to do.”

The 2010 Liberal Democrat manifesto committed the Party to: “Saying no to the like-for-like replacement of the Trident nuclear weapons system, which could cost £100 billion.”

PCS policy is to oppose the renewal of Trident and invest the money saved in public services, whilst safeguarding Ministry of Defence staff jobs.

War in Afghanistan

The war in Afghanistan is currently costing £2.6 billion per year. The war is both unwinnable and is making the world less safe. More important than the financial cost are the countless Afghan and British lives that are being lost in this conflict.

The PCS alternative…

- There is no need for cuts to public services or further privatisations

- Creating jobs will boost the economy and cut the deficit. Cutting jobs will damage the economy and increase the deficit

- We should invest in areas such as housing, renewable energy and public transport

- The UK debt is lower than other major economies

- There is a £120 billion tax gap of evaded, avoided and uncollected tax

- The UK holds £850 billion in banking assets from the bailout – this is more than the national debt

- We could free up billions by not renewing Trident

- End the use of consultants

…

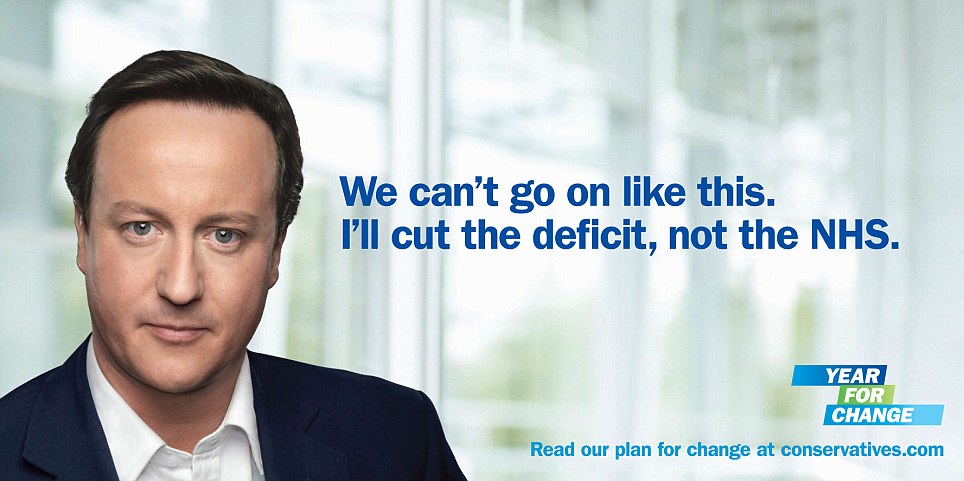

- Conservative election poster 2010

A few recent news articles about the UK’s Conservative and Liberal-Democrat (Conservative) coalition government – the ConDem’s – brutal attack on the National Health Service.

Public services union warns of more industrial action over pensions | Society | guardian.co.uk

Amid a row over the impact of the national 24-hour strike, Mark Serwotka says government needs to make further concessions

A union leader has warned that the “ball is in now in the government court” over public sector pensions and warned that further industrial action would take place if ministers failed to make further concessions.

The coalition government has said that an improved offer tabled on 2 November could be withdrawn if negotiations are not concluded by the end of the year.

Mark Serwokta, the leader of the Public and Commercial Services union, said public sector unions who took strike action on Wednesday had set themselves an earlier deadline of 15 December to decide their next move if the government did not shift its position.

Serwotka hit back at a claim by David Cameron that the mass walkout by 29 different unions across local government, health, the civil service and education had been a “damp squib”.

He said the day was “an outstanding success”, adding: “We haven’t gone on strike to have a strike, we have done it to win concessions on pensions and, in that sense, it’s the government’s move now. We hope they want to talk but, if they don’t, we have to plan for more action. The ball is very much in the government’s court. Two million people have said no to their proposals. They now need to make fresh proposals.”

A spokesperson for the Cabinet Office challenged TUC claims that up to 2 million people took action: “This figure is wrong. The figures we have show turnout was much lower than these claims and significantly less than the unions predicted. In health, civil service and local government there were approximately 900,000 people on strike. We do not have final figures for teachers.”

Disagreement between the two sides was not restricted to the pension deal or the turnout. It also rested on the nature of talks that have taken place since the last deal was tabled, with ministers insisting that talks for each pension scheme have been ongoing, while unions say discussions have either stalled or proved insubstantive.

…

This strike could start to turn the tide of a generation | Seumas Milne | Comment is free | The Guardian

It’s not just the scale of the walkout but the breadth that sets it apart: the ‘big society’, but not as Cameron meant it

It was the wrong time to call a strike. Industrial action would inflict “huge damage” on the economy. It would make no difference. Public sector workers wouldn’t turn out and public opinion would be against them. Downing Street was said to be “privately delighted” the unions had “fallen into their trap”.

The campaign against today’s day of action has been ramped up for weeks, and in recent days has verged on the hysterical. The Mail claimed the street cleaners and care workers striking to defend their pensions were holding the country to “ransom”, led by “monsters”, while Rupert Murdoch’s Sun called them “reckless” and “selfish”.

Michael Gove and David Cameron reached for the spirit of the 1980s, the education secretary damning strike leaders as “hardliners itching for a fight”, and the prime minister condemning the walkouts as the “height of irresponsibility”, while also insisting on the day they had been a “damp squib”.

But up to two million public employees, from teachers and nurses to dinner ladies, ignored them and staged Britain’s biggest strike for more than 30 years. The absurd government rhetoric about gold-plated public pensions – 50% get £5,600 or less – clearly backfired.

It’s not just the scale of the strike, though, but its breadth, from headteachers to school cleaners in every part of the country, that has set it apart. Most of those taking action were women, and the majority had never been on strike before. This has been the “big society” in action, but not as Cameron meant it.

And despite the best efforts of ministers and media, it has attracted strong public sympathy. The balance of opinion has varied depending on the question, but a BBC ComRes poll last week found 61% agreeing that public service workers were “justified in going on strike over changes to their pensions”.

Of course that might well change if the dispute and service disruption drags on. But the day’s mass walkouts should help bury the toxic political legacy of the winter of discontent – that large-scale public sector strikes can never win public support and are terminal for any politician that doesn’t denounce and face them down.

The Tory leadership is unmistakably locked into that Thatcher-era mindset. Not only did George Osborne’s autumn statement this week respond to the failure of his austerity programme by piling on more of the same for years to come, it was also the most nakedly class budget since Nigel Lawson hacked a third off the tax rate for the rich in 1988.

Any claim that “we’re all in this together” can now only be an object of ridicule after Osborne coolly slashed child tax credit for the low paid, propelling 100,000 more children into poverty, to fund new bypasses and lower fuel duty.

…

NHS services hit as thousands join strikes | GPonline.com

Hundreds of thousands of NHS staff are estimated to have taken part in strikes on Wednesday in protest at cuts to public sector pensions.

The strikes forced NHS services in parts of the UK to cancel operations and appointments.

Health union Unison said 400,000 NHS staff took part in industrial action across the UK – close to half the total NHS workforce.

The DoH estimate of NHS staff taking part was far lower, however. A spokeswoman said 79,000 staff – equivalent to 14% of staff in NHS trusts, foundation trusts, ambulance services and NHS Direct – did not go to work on 30 November.

Speaking in parliament on the ‘day of action’ prime minister David Cameron dismissed the strikes as a ‘damp squib’.

But Dr Ron Singer, chairman of the Medical Practitioners’ Union, a branch of public sector union Unite, said: ‘If that’s a damp squib, I hope David Cameron never witnesses a firework display by the public sector.

‘It was a fantastic show of support. To walk with people of all ages and from all backgrounds – nothing like this has happened in 30 years.’

…

‘Nightmare’ NHS reforms will worsen health inequalities – IFAonline

Public health experts fear the government’s plans to reform public health could be a “nightmare” that will make it harder to respond to emergencies and increase health inequalities.

They widely criticised the proposed NHS reforms and suggested the new service would be more fragmented than at present.

The vast majority also rejected one of the government’s key reasons for implementing the Bill, improving care commissioning.

These views were supported by the British Medical Association (BMA) which said the plans could cause problems when planning major events such as the next year’s London Olympics.

A survey of nearly 1,000 public health specialists conducted by the UK Faculty of Public Health (FPH) about the Health and Social Care Bill found that almost three-quarters (71%) of respondents disagreed or strongly disagreed that reforms would create a safer and more effective response to public health emergencies.

Even more (81%) disagreed or strongly disagreed that inequalities in healthcare access would fall, while 83% disagreed or strongly disagreed that the NHS would see less bureaucracy.

A similar number (79%) thought the reforms would lead to the fragmentation of the public health discipline with 50% strongly agreeing.

And three quarters (76%) disagreed or strongly disagreed that the reforms would lead to improved healthcare commissioning, one of the Department of Health’s central reasons for introducing the legislation.

The FPH said the research produced a clear message that there is ‘significant concern about public health’s future – for both the specialty itself and for the future health and wellbeing of the public’.

‘Words such as “chaos” and “nightmare” were used to describe the current and anticipated situation in the NHS and public health systems,’ it added.

The BMA noted that the findings add further weight to calls for the Health and Social Care Bill to be withdrawn.

…

Nursing in Practice – Public sector pay rises capped at 1% for two years

NHS workers will see any pay rises capped at 1% for two years as they prepare to bear the brunt of the UK’s shaky economy.

The cap on public sector pay will kick in during 2013 – when the current pay freeze is set to end – and is likely to be below inflation, leading to a real terms pay cut.

In his Autumn Statement, George Osborne admitted the cuts were “tough” but said the government “cannot afford the 2% rise assumed by some government departments” post 2013.

The pay cap is likely to provide savings of more than £1bn by 2014-15.

While Osborne pledged his commitment to protect NHS spending, Dr Peter Carter, Chief Executive and General Secretary of the Royal College of Nursing (RCN), claimed he has seen no evidence to support this.

Dr Carter described the cuts as “deeply provocative” and “insensitive”.

“We have always accepted that money does need to be saved but this latest attack on pay is another hammer blow to the morale of nurses, who are already in the middle of a two year pay freeze, and who are witnessing the NHS going through unprecedented upheaval,” he said.

“It is for the independent and expert pay review body to recommend an appropriate and fair deal for frontline workers – not the Government.”

…