‘Deeply Troubling’ Lack of UK North Sea Oil and Gas Monitoring

Original article by Andrew Kersley republished from DeSmog.

Fossil fuel giants are largely left to submit their own extraction and emissions data, a freedom of information request shows.

The main regulator of North Sea oil and gas doesn’t conduct physical inspections to ensure companies operating in the region are following the rules, DeSmog can reveal.

The revelations, labelled “deeply troubling” by campaigners, come as the government and the regulator, the North Sea Transition Authority (NSTA), have announced plans to approve drilling at a new oil field, Rosebank, that could produce 69,000 barrels of oil and 44 million cubic feet of gas a day.

DeSmog filed a freedom of information request (FOI) to the NSTA asking the regulator how it ensured companies stayed within the oil and gas extraction maximums outlined in their licences. These rules govern, among other things, how much oil and gas companies are allowed to extract, and the amount of emissions they can produce in the process.

In its response, the NSTA told DeSmog that a company “must notify” the NSTA if a production limit is breached in the North Sea, but that the NSTA itself “does not undertake offshore inspections to ensure compliance with production consents”.

When asked how, given the lack of inspections, the regulator would ensure that companies are being accurate when they self-report the emissions being produced, the regulator said it hosted “an annual consents exercise” (seemingly a single meeting) during which they remind operators of “their obligations and how to ensure they remain in regulatory compliance”.

The findings suggest that operators in the North Sea are left to largely self-regulate – declaring themselves when they break the legal rules governing their operations.

According to Violation Tracker UK, the NSTA has issued just two fines worth £100,000 since 2021 related to companies exceeding the oil and gas extraction limits in their licence.

“This FOI reveals deeply troubling findings about the lack of proper regulation of North Sea oil and gas extraction,” said Matthew Lawrence, the director of the Common Wealth think tank.

Daniel Jones, a researcher at the campaign and research group Uplift, added that “The NSTA has never acted like a regulator in the normal sense, preferring to steer and encourage the industry into behaving responsibly, rather than mandating that companies reduce their environmental impact.

“It’s only very recently, in 2021, that the NSTA introduced any mechanisms at all to tackle the huge emissions from producing oil and gas, which account for 4 percent of all UK emissions, and even these require companies to do very little”.

‘Light Touch Regulation’

The NSTA, formerly the Oil and Gas Authority, is a private company wholly owned by the government, which primarily seeks to “maximise” the economic output of North Sea oil and gas, and aid the transition to net zero.

This month, the company awarded the UK’s first ever licences for carbon capture and storage (CCS), which it said “could store up to 30 million tonnes of CO2 per year”. However, the role of CCS in the energy transition is hotly contested.

Climate scientists point to the failure of CCS to remove significant amounts of CO2 emissions, while campaigners warn of the high costs compared to renewable energy. The vast majority of companies also use the captured CO2 to extract more oil through a process called “enhanced oil recovery”.

Stuart Haszeldine, professor of carbon capture and storage at the University of Edinburgh, has compared commissioning CCS sites as well as new oil fields to ordering a truckload of cigarettes for someone giving up smoking.

DeSmog’s new findings also raise concerns about the monitoring of illegal flaring – the burning of excess natural gas produced during the oil and gas drilling process, which produces hundreds of millions of tonnes of CO2 emissions a year.

According to Violation Tracker UK, the NSTA has issued two fines for flaring since 2021, worth a total of £215,000.

In 2022, £65,000 fine was imposed on Equinor, the firm that owns much of the new Rosebank oilfield. Two years prior, Equinor had flared at least 348 tonnes of CO2 over and above the amount it was permitted to burn. Even that failure was considered an “administrative breach” by the NSTA. In the first six months of 2023, the Norwegian-owned energy company posted profits of £17.1 billion.

The UK’s operations in the North Sea produce almost three times the direct greenhouse gases per barrel of oil than our neighbour Norway, largely due to a significantly higher use of flaring on UK-regulated oil rigs. In 2022, UK North Sea operations burned 22 billion cubic feet of gas in offshore flaring.

DeSmog’s findings come just days after the NSTA announced it was approving plans for the Rosebank oilfield, with a government minister claiming the move would lead to “lower emissions” in the UK.

The field has the potential to produce 500 million barrels of oil in its lifetime, which when burned would emit as much carbon dioxide as running 56 coal-fired power stations for a year.

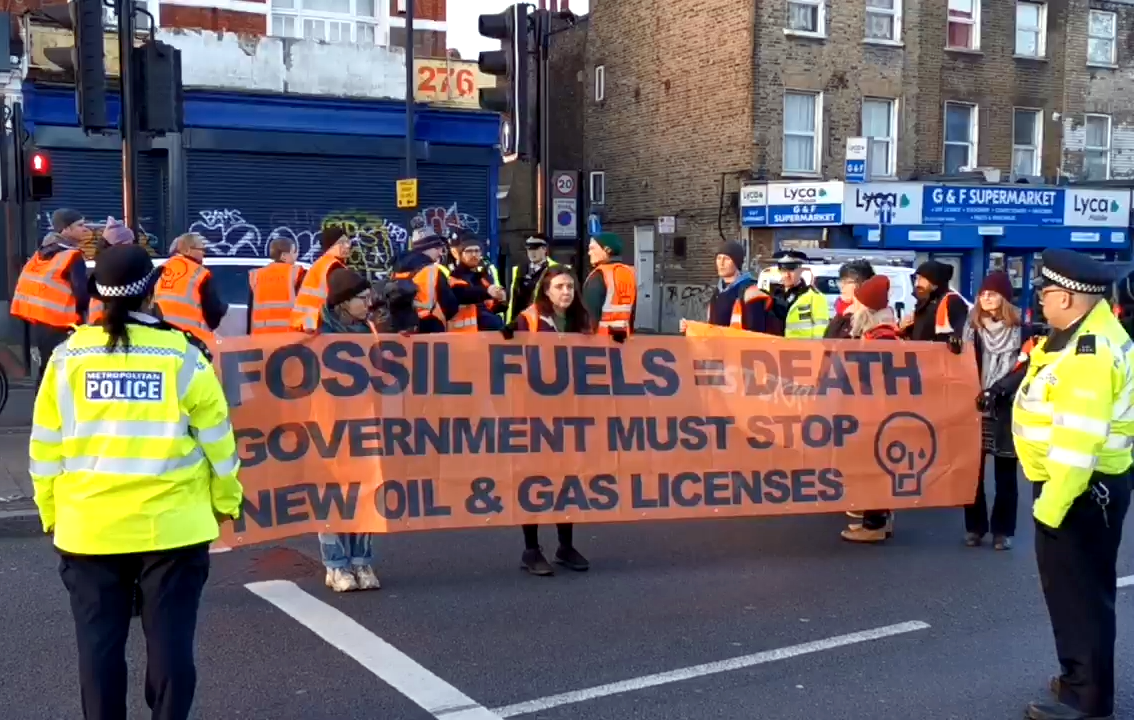

Campaigners including Greta Thunberg have expressed their anger at the proposals, with Green Party MP Caroline Lucas describing the project as “the greatest act of environmental vandalism in my lifetime”.

The government has also said it will imminently issue hundreds of new licences for oil and gas exploration in the North Sea, while Prime Minister Rishi Sunak has announced the watering down of several key net zero targets.

The International Energy Agency warned in May 2021 new fossil fuel developments were incompatible with the effort to limit global temperature increases to 1.5C above pre-industrial levels.

There are currently 283 active oil and gas fields in the North Sea, and the production process alone generated 13.1 million tonnes of direct CO2 emissions in 2019.

Matthew Lawrence of Common Wealth added that, “Decades of light touch regulation and privatisation have led to an energy system – from North Sea extraction to the super profits being made in energy generation and distribution – geared toward profit maximisation at the expense of people and planet.

“In this context, the government’s decision to approve the Rosebank oilfield and issue 100 new licences for fossil fuel extraction pose an even more grave risk to the climate.

“The alternative is a clean energy system based around meeting public and environmental needs”.

A spokesperson for NSTA did not address any of the findings in the freedom of information request, but stressed that the majority of flares “are fitted with metres” and the group is working to “increase the use of direct measurements”.

They added that government departments receive “actual emission data” on North Sea oil operations and that the NSTA was “working with [the Offshore Petroleum Regulator for Environment and Decommissioning] to improve the visibility of this data and help industry increase the accuracy of emissions measurement”.

Original article by Andrew Kersley republished from DeSmog.