Emma Thompson Chills on $200 Million Superyacht Eos Like a Millionaire Hypocrite

…

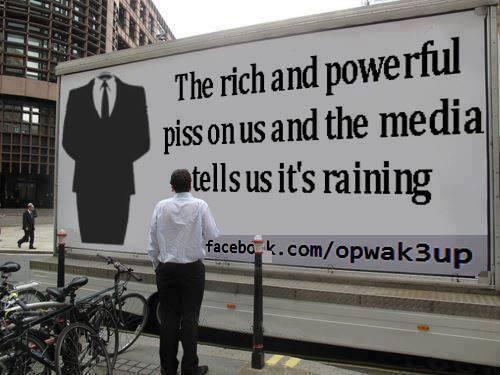

Emma Thompson is a name that comes up often whenever there’s a larger discussion about eco-hypocrites among A-list celebrities. Just like that doctor who can’t be bothered to put out his own cigarette while he’s scolding you for not being able to kick the habit, some celebrities who get very passionate in their discourse on climate issues fail to live up to the expectations their discourse gives way to. Thompson is one of them.

Examples abound. She once flew private out of Los Angeles and into London just so she could attend an Extinction Rebellion march in the capital. Just to put this in the right light, she flew private to London to join a march on the dangers of climate change and urging us, regular folk, to ditch commercial flights to save our planet – no ifs and buts about it.

Thompson often speaks at rallies of this kind, yet she owns homes in three different countries and often jetsets from one to the other – not flying commercial, but private. She is just one of the many examples of holier-than-thou-type of stars who preach extreme measures only for show while they continue living their life as before.

This is necessary context in order to understand the fresh wave of criticism directed at her: Emma Thompson is now in Venice, where she owns a home and is an honorary citizen, vacationing onboard the Eos superyacht. Eos is an older build from luxury shipyard Lurssen that previously held the record as the world’s largest sail-assisted superyacht before Amazon CEO Jeff Bezos had Koru delivered.

…

Wealthiest 10% of US Households Responsible for 40% of Greenhouse Gas Emissions: Study

Original article by BRETT WILKINS republished from Common Dreams.

“Without policies such as regulations or taxes on very polluting investments, it’s unlikely that wealthy individuals making a lot of money from fossil fuel investments will stop investing in them,” says one economist.

The richest tenth of U.S. households are responsible for 40% of all the nation’s greenhouse gas emissions, a study published Thursday revealed, underscoring what progressives say is the need for regulations and taxes on carbon-intensive investments.

Published in PLOS Climate, the study—which was led by University of Massachusetts, Amherst sustainability scientist Jared Starr—analyzed 30 years of U.S. household income data and the greenhouse gas emissions generated in creating that income.

“We find significant and growing emissions inequality that cuts across economic and racial lines,” the paper notes. “In 2019, fully 40% of total U.S. emissions were associated with income flows to the highest earning 10% of households.”

“Among the highest-earning 1% of households (whose income is linked to 15-17% of national emissions), investment holdings account for 38-43% of their emissions,” the publication continues. “Even when allowing for a considerable range of investment strategies, passive income accruing to this group is a major factor shaping the U.S. emissions distribution.”

“It just seems morally and politically problematic to have one group of people reaping so much benefit from emissions while the poorer groups in society are asked to disproportionately deal with the harms of those emissions.”

The study’s findings are consistent with research published in 2021 by the Institute for European Environmental Policy and the Stockholm Environment Institute that estimated the wealthiest 1% of humanity was on track to produce 16% of all global CO2 emissions by 2030. Additionally, a 2022 Oxfam report found that a single billionaire produces a million times more carbon emissions than the average person.

Starr toldThe Washington Post that “as you move up the income ladder, an increasing share of emissions is associated with investments.”

According to the Post:

Then there were “super-emitters” with extremely high overall greenhouse gas emissions, corresponding to about the top 0.1% of households. About 15 days of emissions from a super-emitter was equal to a lifetime of emissions for someone in the poorest 10% in America.

The team found that the highest emissions linked to income came from white, non-Hispanic homes, and the lowest came from Black households. Emissions peaked until age 45 to 54, and then declined.

“It just seems morally and politically problematic to have one group of people reaping so much benefit from emissions while the poorer groups in society are asked to disproportionately deal with the harms of those emissions,” said Starr.

The study asserts that “results suggest an alternative income or shareholder-based carbon tax, focused on investments, may have equity advantages over traditional consumer-facing cap-and-trade or carbon tax options and be a useful policy tool to encourage decarbonization while raising revenue for climate finance.”

Lucas Chancel, a French economist who was not part of the study, told the Post that “all Americans contribute to climate change, but clearly not in the same way.”

“Without policies such as regulations or taxes on very polluting investments,” he stressed, “it’s unlikely that wealthy individuals making a lot of money from fossil fuel investments will stop investing in them.”

Original article by BRETT WILKINS republished from Common Dreams.

This article is about the rich having high climate impacting investments in addition to high climate impacting lifestyles.

RELATED

‘Modest’ wealth tax on richest 0.3% could raise more than £10bn for public services, says TUC

The trade union body has set out options for taxing the small number of individuals with wealth over £3 million, £5 million and £10 million

A modest wealth tax on the richest 140,000 individuals in the country could raise more than £10bn to help pay for public services, according to the Trades Union Congress (TUC).

With the country’s public services in a dire state and with the Tories repeatedly using excuses about not having enough money to invest in them, the TUC has set out a clear plan for how further money could be raised, by taxing the wealthiest 0.3% of the UK population, as it called for a “national conversation about taxing wealth”.

The trade union body has set out options for taxing the small number of individuals with wealth over £3 million, £5 million and £10 million, excluding pensions. It says that the options are illustrative examples of what a wealth tax could look like, using Spain’s existing policy as a potential model.

It proposes the following:

- A wealth threshold of £3 million with a marginal tax rate of 1.7% would yield £2.7 billion (with the tax payable on wealth above £3 million by 142,000 individuals or 0.27% of adults in the UK)

- A further wealth threshold of £5 million with a marginal tax rate of 2.1% would yield an additional £3.2 billion (with the tax payable on wealth above £5 million by 48,000 individuals or 0.09% of adults in the UK)

- A further wealth threshold of £10 million with a marginal tax rate of 3.5 % would yield an additional £4.6 billion (with the tax payable on wealth above £10 million by 17,000 individuals or 0.02% of adults in the UK).

‘It’s time to start a national conversation about how we tax wealth in this country’

TUC launches blueprint to squeeze Britain’s multimillionaires for a ‘modest’ proportion of their wealth and end the country’s ‘increasing wealth inequality’

THE TUC has condemned a “tale of two Britains” which sees working people suffering “the longest pay squeeze in modern history” while bankers’ bonuses are at eye-watering levels and chief executive pay is surging.

The damning criticism came as the TUC launched a blueprint to squeeze Britain’s multimillionaires for a “modest” proportion of their wealth and end the country’s “increasing wealth inequality.”

The blueprint would raise £10 billion for the public purse and should be the “start of a national conversation about taxing wealth,” said TUC general secretary Paul Nowak.

It would affect only 140,000 individuals — 0.3 per cent of Britain’s population — and is similar to a policy that operates in Spain.

Mr Nowak said: “It’s time to start a national conversation about how we tax wealth in this country.

…

- Go to the previous page

- 1

- …

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- …

- 21

- Go to the next page