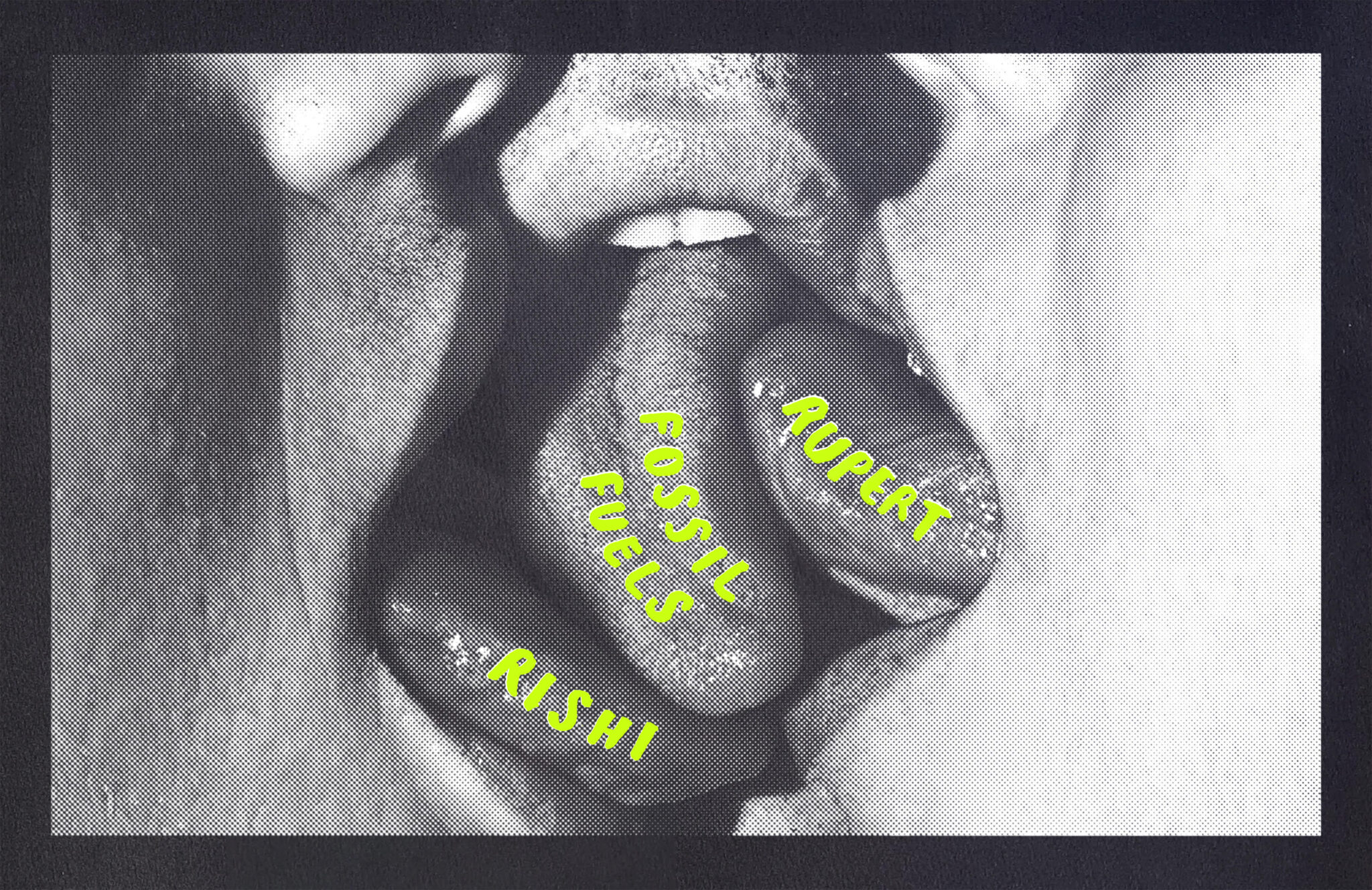

FFS Fossil Fuel Subsidies continue to be huge in UK and globally despite the urgent need to move away from the use of fossil fuels since they are the main cause of the climate crisis. Current estimates of FFS are 4% of GDP globally and 2% of GDP in UK. FFS that’s huge FFS. We only have estimates of FFS because FFS are not specifically acknowledged with governments disguising FFS by selecting definitions that hide their FFS FFS. Please publish your own article if you know FFS better than me FFS.

FFS? FOSSIL FUELS SUPPORT IN THE UK TAX SYSTEM

… the UK continues to offer a number of tax reliefs for both domestic production and consumption of fossil fuels. In the last 5 years, the value of UK support to fossil fuels mounted to approximately £12bn annually on average.

…

In the face of the climate and environmental crises, and the short timeframe left to avert breakdown, it is increasingly clear that the current rate and scale of action will not deliver a safe future. In place of this we need a deep transformation of design and operation of the economy. This will require structural policy shifts, as well as a step-change in public investment. Tax revenues can play an important role in sustainably servicing this increased borrowing. Crucially though, by bringing together the twin goals of a Green New Deal – securing economic and climate justice — a reimagined UK tax system can play a central role in driving a more equitable distribution of wealth while reorienting economic activity away from high-carbon production and consumption. Phasing out UK fossil fuel support needs to be part of a coherent strategy to ensure an orderly, just, and rapid transition.

…

…

Under a new plan, oil and gas firms can access a “super-deduction” investment allowance which means for £1 spent in “UK extraction” up to 91% of the costs will be covered by the tax saving.

This deduction is covered from the point of investment, rather than at the point the project starts producing. Many green experts have noted that “UK extraction” is a vague term, but one that points to major tax reliefs for energy giants that invest in the extraction of more UK-based oil and gas fields.

…

That’s a huge incentive for fossil fuel companies to extract from previous Chancellor and current Prime Minister Rishi Sunak FFS: It will cost them only 9p for a £ of investment.

FFS: Energy crisis: Governments spent more than €900 billion on fossil fuel subsidies in 2022

These calculations show how a renewable energy transition would save everyone money FFS

The last drop: Why it is not economic to extract more oil and gas from the North Sea FFS