We need a Revolution. What’s the plan?

https://juststopoil.org/2024/03/03/we-need-a-revolution-whats-the-plan/

This system is fucked, politics is failing us, we need a revolution or we really do face rule by ‘the mob’. As we pass through 1.5C of heating to 2C and then the predicted 3C in the lifetime of many alive today, we will lose all we cherish and value. Our treasured landscapes, the rule of law, education, healthcare, pensions – and yes the people we love. We will not be able to feed ourselves and those who rule us do not care. Look at Gaza, this is what they are prepared to let happen. Genocide is now acceptable.

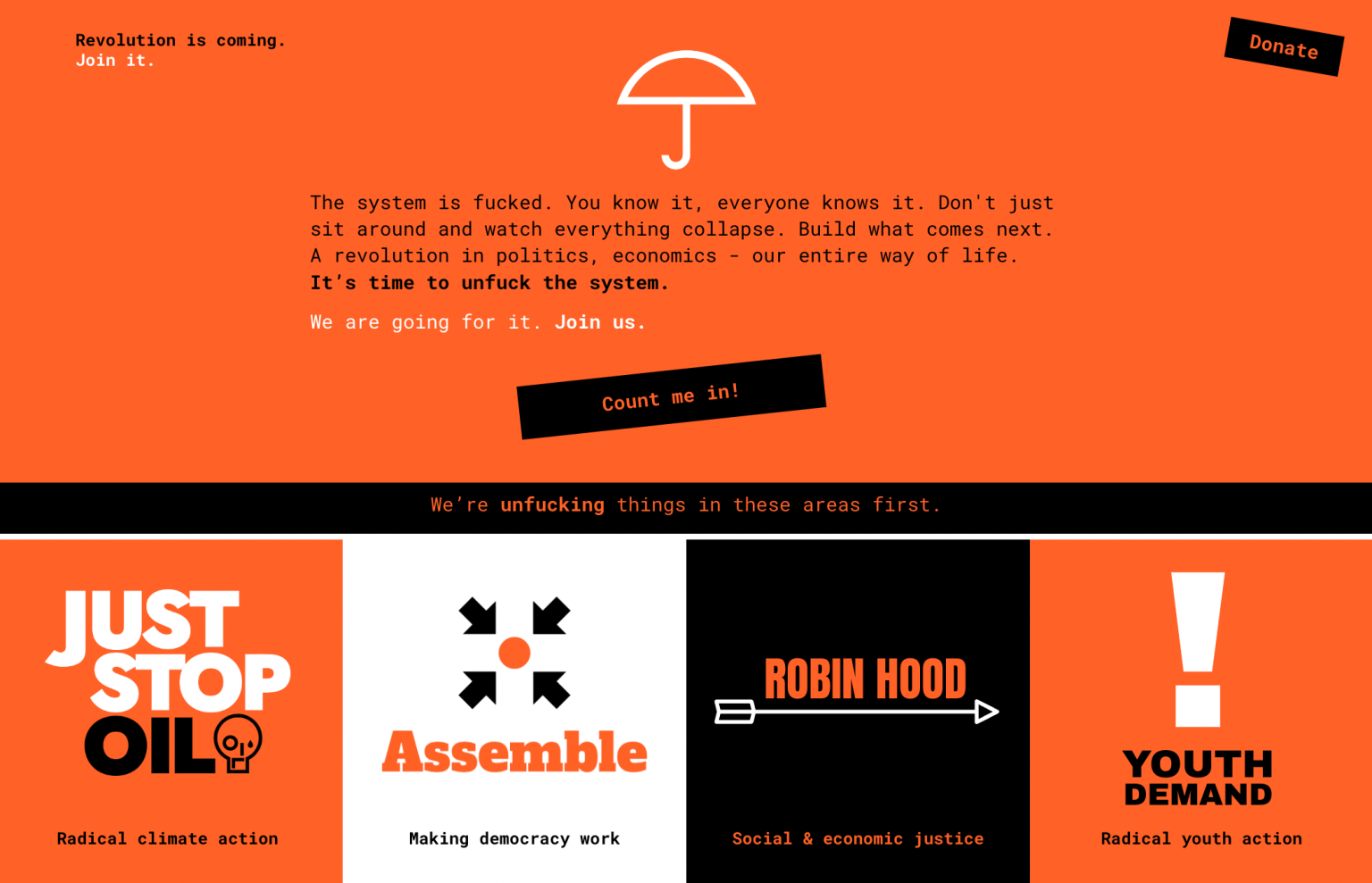

In response, nonviolent civil resistance to a harmful state will continue, with coordinated, radical actions that reach out to new people and capture the attention of the world. Alongside this, a new political project will be set up. This will run local assemblies and will support and stand candidates to shape the electoral debate. A coordinating structure known as Umbrella, will support these projects and this will be the heart of our community of resistance.

Just Stop Oil will continue to be the major focus until we win, but we have a new three part demand: No New Oil, Revoke Tory Licences and Just Stop Oil by 2030. In addition to disrupting high-profile cultural events and continuing our Stop Tory Oil campaign, focussing on MP’s and those in power, this summer Just Stop Oil will commence a campaign of high-level actions at sites of key importance to the fossil fuel industry – airports.

In addition to Just Stop Oil, young people and students will be taking action in a new campaign that will demand an end to genocide – both in Palestine, and globally, from the continued drilling and burning of oil and gas.

Umbrella will launch Assemble, a democracy project that will mobilise hundreds of people by running local assemblies on issues of concern to communities across the country and giving them pathways to action. The goal is to create a “People’s House” to parallel the House of Commons as the first step towards having permanent legally binding citizens assemblies- a democratic revolution.

Umbrella will be the hub for fundraising, mobilisation and directing resources to a range of new campaigns and groups, including Robin Hood, a major new campaign based around a demand to properly fund our public services by taxing the richest in society.

Each of these campaigns will share the values of nonviolence and accountability.

The system is fucked. You know it, everyone knows it. Don’t just sit around and watch everything collapse. Build what comes next: a revolution in politics, economics – our entire way of life.

It’s time to unfuck the system.

We are going for it. Join us.

https://juststopoil.org/2024/03/03/we-need-a-revolution-whats-the-plan/

/bnn/media/post_attachments/content/uploads/2023/12/swiss-inheritance-tax-proposal-20231227145538.jpg)