Barclays’ $2bn coal loans expose ‘enormous loophole’ in its climate policy

Original article by Josephine Moulds republished from The Bureau of Investigative Journalism under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Unported License.

Bank accused of ‘trying to have it both ways’ with coal policy that allows financing for huge polluters

Barclays helped raise nearly $2bn for companies running highly polluting coal-fired power plants in the US, exposing an “enormous loophole” in its climate policy.

As part of its strategy to reach net zero, the bank has committed to stop financing companies that make more than half their revenues from coal-fired power.

Last year, however, Barclays helped raise $1.7bn for coal-fired power companies that appear to exceed that threshold, the Bureau of Investigative Journalism and ITV News can reveal.

Among these deals were two $400m loans for Monongahela Power, which generates 95% of its electricity from burning coal at two huge plants in West Virginia. The company only sells electricity that it generates itself, suggesting that the vast majority of its revenues are from coal-fired power.

Barclays, however, said its policy only prohibits financing for companies that make more than 50% of revenues specifically from generating coal-fired power; and that TBIJ’s calculations did not account for these companies’ revenues from transmitting and distributing that power.

Seth Feaster, an analyst at the Institute for Energy Economics and Financial Analysis (IEEFA) think tank, said: “The bank is trying to have it both ways: a public-facing coal policy that sounds like it will no longer support coal-heavy companies, but the technicality [regarding transmission and distribution revenue] has rendered that policy largely meaningless.

“The bank has created an enormous loophole that appears to allow it to largely continue doing business as usual with coal-friendly utilities.”

Natasha Landell-Mills, head of stewardship at the asset manager Sarasin & Partners, which holds Barclays debt, said the bank’s position appeared to be “somewhat disingenuous”.

“In the end, what matters is that coal-fired power falls in keeping with ensuring a safe climate. As investors, we would expect all related activities that enable coal-fired power to be captured and, if they are not, would hope to see the board urgently address this loophole.” She said this was not just a question of how Barclays is run and its reputation, but that continuing to fund high emitters was also financially risky for long-term investors.

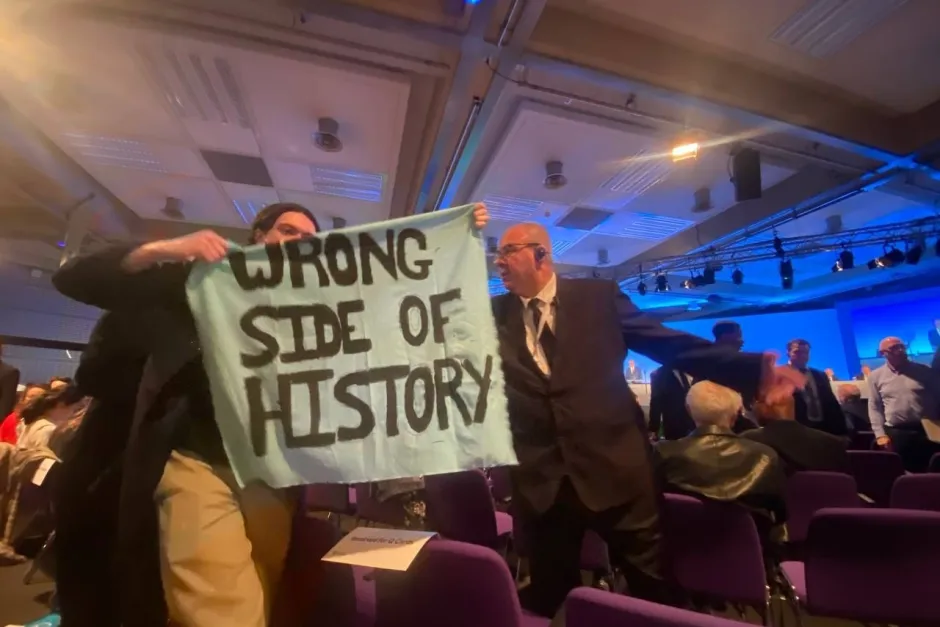

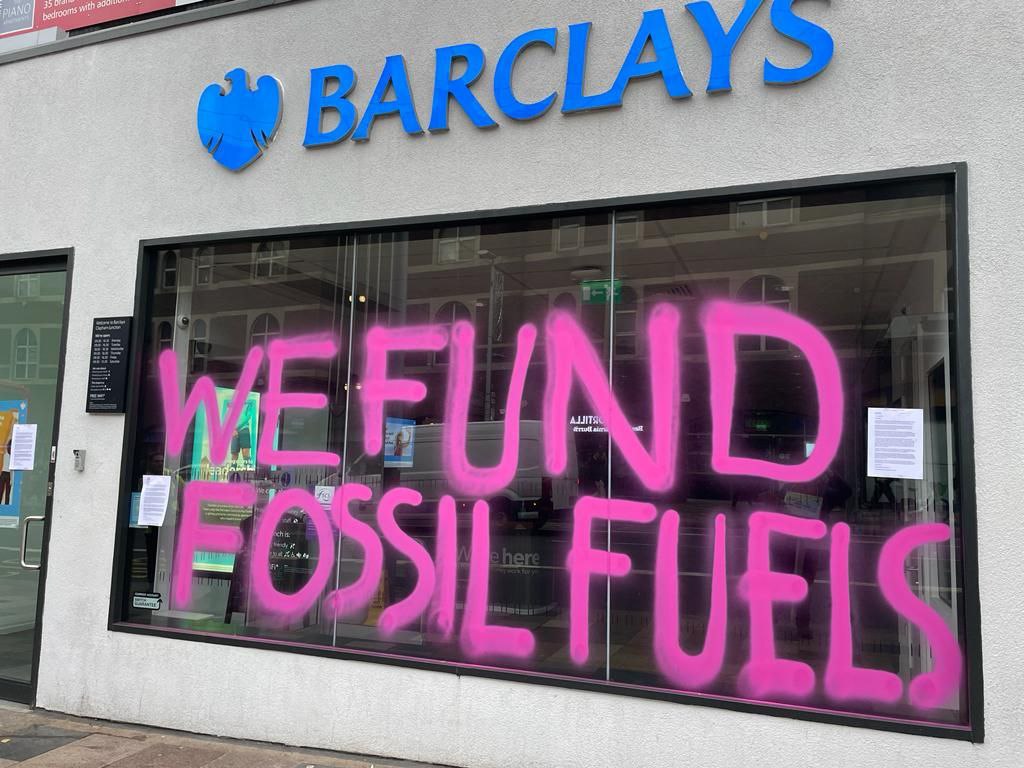

The news comes amid a storm of protest against the bank, which was revealed in May to be Europe’s biggest funder of fossil fuels.

It is also Europe’s biggest lender to the coal power industry, taking part in $75bn worth of deals for companies active in the sector last year.

Bold pledges

Under pressure from its customers and investors, Barclays has made increasingly bold climate promises. It tightened its coal policy in 2022 and said financing the sector not only poses a threat to the planet but could represent a bad lending decision. Yet a number of companies it funded last year appear to be making most of their money from coal-fired power.

In addition to the Monongahela Power deals, Barclays helped raise $400m for Kentucky Utilities, which in 2022 generated almost three quarters of its electricity from burning coal. This suggests more than half its revenues were from coal-fired power.

Barclays also helped raise a $500m loan for Louisville Gas & Electric, which generated 83% of its power from coal in 2022. It makes some revenues from selling gas but calculations based on company and government data suggest its revenue share from coal was more than 50%.

Neither company appears to be transitioning to renewable power and their owner, PPL Corporation, said it expects they will use coal and natural gas as their predominant fuels “for the foreseeable future”.

Monongahela Power is investing millions to keep its two West Virginia plants running until 2035 and 2040, despite scientists warning that developed countries must end power generation from coal by 2030. The company aims to build 50MW of solar generation, but that represents less than 2% of its current coal-fired power capacity.

Barclays told TBIJ the deals complied with its policy “based on publicly disclosed information and our due diligence”. It said its policy does not have a loophole and that its methodology is robust. “An ambition to be net zero by 2050 does not require an immediate exit from financing coal,” the bank said. “Barclays is financing an energy sector in transition, providing finance to meet current energy needs and also financing the scaling of clean energy”.

PPL, which owns utilities in Kentucky, Rhode Island and Pennsylvania, said it had set a clear goal to achieve net-zero carbon emissions by 2050 and was transitioning to a cleaner energy mix across the group. It added that it had received approval from the authorities to retire 600MW of coal-fired power generation in Kentucky by 2027. This, however, represents less than 15% of its remaining coal capacity.

Monongahela Power did not respond to TBIJ’s request for comment.

Deadly coal plants

Coal-fired power plants are responsible for more than 40% of global CO2 emissions from energy. At Cop28 UN climate talks in Dubai last year, all countries agreed that accelerating the transition from coal to renewables was essential in order to avert catastrophic climate change.

Coal is also a major source of toxic air pollution. In the US alone, more than 3,800 people die from soot released by coal-fired power plants every year, according to a report by Sierra Club, a US NGO. While many European banks have distanced themselves from the industry, Barclays has retained strong links with US coal-fired power companies.

The boom in fracked gas and plunging cost of renewables has changed the landscape for power generation in the US. Seth Feaster at IEEFA said: “[Coal-fired power] companies are going to start struggling because they can’t sell their power in competitive environments.

“Investing in coal is very risky because most of [these coal plants] are losing money. They’re not going to be around for very long and if something breaks, they tend to shut down early because they can be very costly to repair.”

Bob Ward from the Grantham Research Institute on Climate Change said: “The coal industry in the United States is failing, it’s on its way out … there’s no excuse for propping up the American coal industry.” He described the distinction Barclays made between the generation, transmission and distribution of electricity from coal in its policy as “semantics”.

“What consumers and investors will be expecting is that Barclays are complying with the spirit of their declarations, and not just a technicality,” Ward said. “If you are generating most of your income from burning coal and then distributing the electricity results, then that’s the coal. That’s the coal industry. You’re damaging the climate. And that is what Barclays said they would stop.”

Last month, the organisers of the Wimbledon tennis championships faced calls to drop Barclays as a sponsor over its ties to fossil fuels and defence companies supplying Israel. Barclays addressed criticism of its defence funding, saying it trades in shares on behalf of clients. “Whilst we provide financial services to these companies, we are not making investments for Barclays.”

Live Nation also dropped the bank as a sponsor for various music festivals – including Download, Latitude and Isle of Wight – after protests from bands and fans.

Steff Wright, chairman of the Gusto Group, said his construction and manufacturing business is moving away from banking with Barclays. “As a company that’s working towards a green future, we need to look at our supply chain and who else is on that journey with us.

“We’d encourage all businesses to move away from them, to put pressure on them to rethink their strategy.”

Reporters: Josephine Moulds

Environment editor: Robert Soutar

Impact producer: Grace Murray

Deputy editors: Chrissie Giles and Katie Mark

Editor: Franz Wild

Production editor: Alex Hess

Fact checker: Somesh Jha

This reporting is funded by the Sunrise Project. None of our funders have any influence over our editorial decisions or output.

Original article by Josephine Moulds republished from The Bureau of Investigative Journalism under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Unported License.

More from this project

Barclays’ billions of ‘sustainable’ finance for fossil fuel industry is greenwash, says investor

HSBC helped oil and gas industry raise $47bn despite net-zero pledge

How will new FCA greenwashing rule tackle banks’ dodgy climate claims?