Give Climate Change the Name It Deserves: Fossil-Fueled Destruction

Original article by Mark Shapiro, Capital & Main republished from DeSmog.

“Climate Crisis” only identifies the symptoms of oil and gas dependence. As time runs out, we need a term that focuses on what — and who — is to blame.

This article by Capital & Main is published here as part of the global journalism collaboration Covering Climate Now.

There’s always a lag between a rupture of the status quo and settling on a word for it. The planet is heating at a life-threatening pace. And yet the two words we use to describe this rupture — “climate” and “change” — are beginning to seem too stiff and one-dimensional for conveying the violence to life-sustaining ecosystems that threaten the world as we have known it.

As delegates from 196 countries attempt, for the 28th time, to reach a global agreement to reduce greenhouse gases, it is time for a new language. The violence of the atmospheric shifts, their deeply uneven impacts and the implications of mass extinctions that are expected at current emission levels, add up to much more than “climate change.” The 28th United Nations Conference of the Parties (COP28) in the United Arab Emirates is being held in a region much of which could, according to current climate modeling, be uninhabitable by mid-century. It is time to more sharply focus the attention on those responsible for the violence of the changes underway.

Linguistic theory holds that words enable us to imagine a thing; it’s the words that come first. First there was the “greenhouse effect” — a phenomenon identified as early as 1856 by a largely unheralded woman scientist, Eunice Foote, who reported at the time that glass jars filled with air laced with carbon dioxide heated up much quicker than air without it. More than a century later, at a 1988 congressional hearing, James Hansen, then director of NASA’s Institute for Space Studies, would testify about the links between rising temperatures on Earth and rising CO2 levels in the atmosphere, and point the finger at those responsible: humans. The term “global warming” stuck. Over the 170 years since Foote’s discovery, the concentration of CO2 in the atmosphere has leapt from 290 parts per million to more than 400 ppm today.

By the early 21st century, the effects of all that extra CO2 began to be widely felt. Scientists came to recognize that “warming” sets off a cascade of changes — from shifts in rainfall patterns to volatile swings between rain and drought, and heat and cold, as well as major disruptions to the flow of ocean currents. “Climate change” seemed to encompass more possibilities for derangements of the global ecosystem. And that term is rapidly being outrun by the speed of the changes.

“Climate emergency” was chosen as the Oxford English Dictionary’s “Word of the Year’’ in 2019. That was two years after the Guardian led the world’s newspapers in adopting the term “climate crisis,” to be used interchangeably with “emergency.” The Guardian was far ahead of the curve in evoking the urgency of reporting on the scale of disruptions triggered by greenhouse gases. That tonal change drove home the point that this was not merely a phenomenon to be described, but a tectonic shift demanding ongoing reporting. Nothing, however, can stay ahead of the curve for long; soon enough the curve curves. It’s time for journalists, and everyone else, to consider some additional words and subordinate clauses that evoke the violence of the changes in the present, and identify those accountable for the upending of the status quo now underway in full throttle.

We are living in the climate warp. Yet it is admittedly difficult to clarify in a word or a phrase the vast scope of impacts, which range from the epic to the highly specific. Climate-induced drought was one of the triggers to the Syrian civil war and also fuels the current battle between California and its neighbors over access to the Colorado River. It is helping drive the decimation of farmer livelihoods that is leading to the crush of new immigrants on America’s and Europe’s borders. It contributed to the record-breaking heat that caused the untimely death of a Taylor Swift fan in Rio de Janeiro. Such conflicts and record-breakers are happening hourly somewhere in the world.

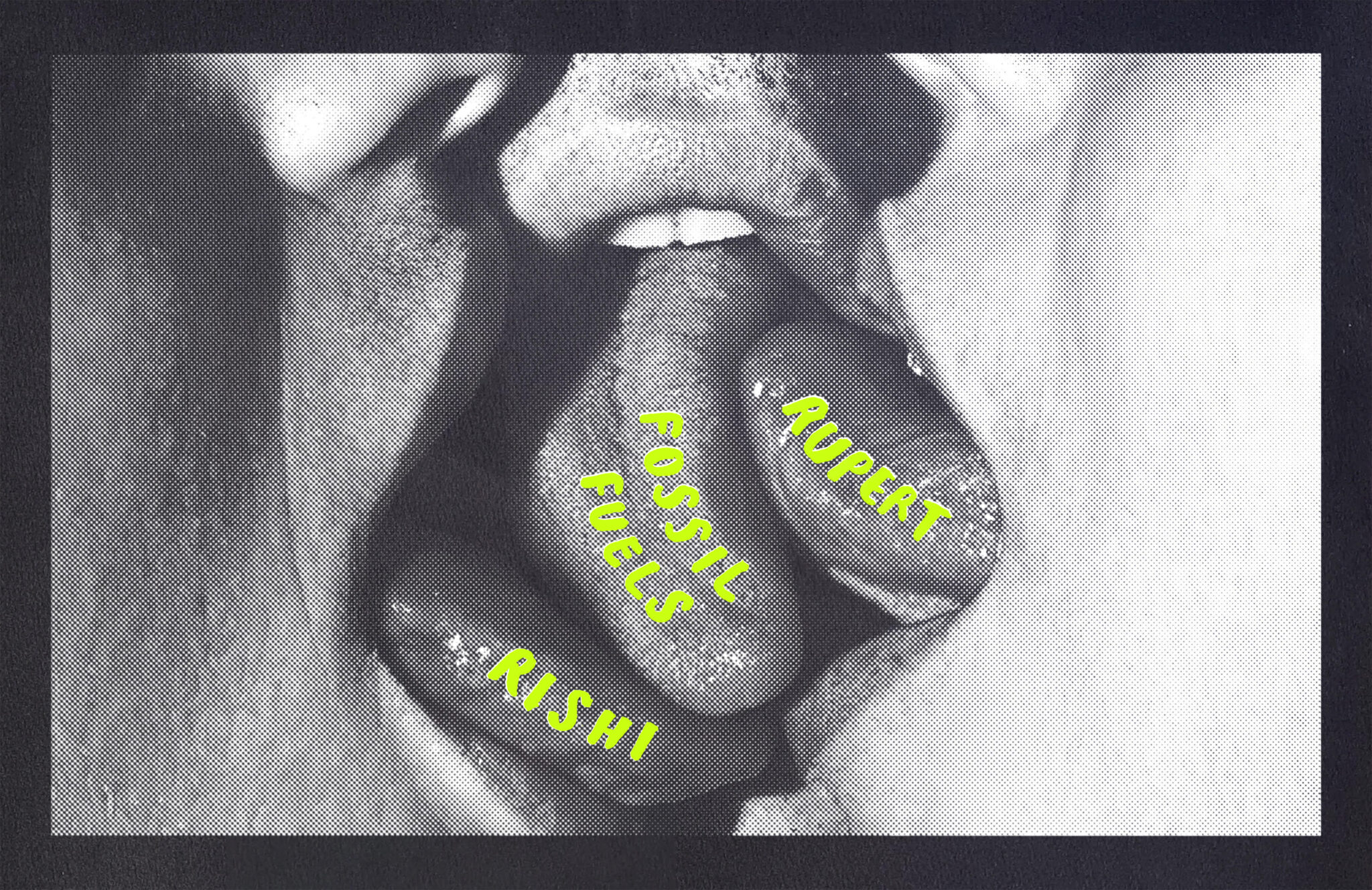

“Climate change” describes only the result of fossil fuel-based greenhouse gases. A term like “fossil fueled-destruction” would name the cause as well as the effect.

There are two tools now available to journalists to more clearly show who can be held accountable for the devastating impacts of the changing climate. Major advances in the attribution sciences provide ever-more sensitive understanding of how the overheated atmosphere is disrupting conditions here on Earth. And, critically, ever more precise research into the history of greenhouse gas emissions establishes who can be held accountable.

During this last season of record-breaking summer and fall temperatures, one meteorologist suggested naming the heat waves after those responsible, as in, the “Amoco heatwave,” or the “Exxon hurricane” or the “Chevron drought.” While droughts have been in California’s backbeat for as long as there are historical records, Chevron’s global emissions of some 725 million tons of greenhouse gases including CO2 in 2022 directly contribute to their increasing breadth and duration, as they do to increasing water scarcity pressures in other parts of the world. (The company’s “offsets” of those emissions were found recently to be “mostly junk.”)

We know who is responsible for the overwhelming share of greenhouse gas emissions, and thus for the massive chaos being wrought. They are not hidden behind tax shelters or front companies. They are polluting in plain sight. A new language might incorporate that knowledge: At least one of the 90 companies responsible for practically all greenhouse gas emissions since 1850 is operating a refinery near you, or distributing its greenhouse gas emitting products at a gas station, seaport or airport in the neighborhood.

Cognitive Dissonance Ahead

We consumers also bear some responsibility; we’ve been driving around in those gas-powered cars since James Hansen delivered the news 25 years ago. But we’ve also been driving through a fog of disinformation. The fossil fuel industry hid for decades what it knew about the impacts of its products. Those “deceptions,” California alleges in a historic lawsuit against the top five oil companies in the state, “caused a delayed societal response to global warming. And their misconduct has resulted in tremendous costs to people, property, and natural resources, which continue to unfold each day.”

A recent study of the four largest U.S. and European oil companies (ExxonMobil and Chevron, BP and Shell) in the science journal PLOS One found a widening gap between what they say they are doing in response to the climate crisis and what they continue to do to cause it. The study concludes with a classic of scientific understatement: “[T]he magnitude of investments and actions does not match the discourse.” In the climate lexicon, it is hard to beat the term “greenwashing,” which is no doubt on abundant display in Dubai. But that study and countless others like it are a warning shot for journalists and the public to cast a wary eye on fossil fuel companies’ claim that they are working towards the “energy transition” away from the old dinosaur bones they’ve been mining that are polluting the world.

While COP28 in Dubai is awash in fossil fuel lobbyists, it has also established the world’s first “loss and damage” fund, and will likely be coming up with some actual money to assist the 90% of the world’s population that did not produce the greenhouse gas emissions but are suffering their consequences. A new word may also soon enter the popular lexicon, if it’s not there already: “incremental.” Which may not be revolutionary, but also has real impacts. Every incremental reduction in greenhouse gases, or incremental increase in funding, could mean the difference between a coastal community being inundated or not, of another year saved from a 10th of a degree Celsius increase, of another year spent on a sub-Saharan grassland before it turns to desert. Such increments are the new climate currency.

And for those of us in the fortunate climes, it means more fall seasons that feel like spring, more 65 Fahrenheit winters that should no longer be termed “unseasonably warm.” The writer Stevie Chedid calls it “warning weather.” A disquieting warning in the humid warming air.

Original article by Mark Shapiro, Capital & Main republished from DeSmog.